Off-market flips, rentals, and rehabs for cash or hard-money buyers.

Real properties. Real numbers. Real speed.

I’m Tim LaBorde, a Houston-based investor and real estate agent who has helped Texas buyers find real off-market opportunities since 2011. I work with serious cash and hard-money buyers to secure undervalued homes with equity, rental potential, or room for improvement. Most of these deals close before they ever reach the public market.

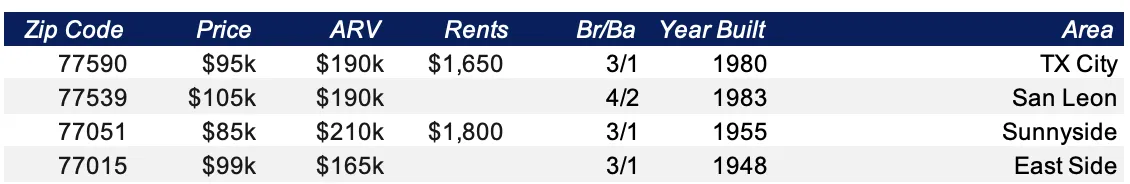

Our recent actual closings show a variety of investor opportunities we’re seeing around the Texas Triangle — from light to heavy rehabs in solid neighborhoods with room for value-add improvements. These moved quickly, with cash or hard-money buyers stepping in before they ever hit the broader market.

Investor activity has surged from Katy to Baytown, with closings between $65K and $535K. Each property offered strong value-add or rental potential.

Recent Closings:

58 Trenwood Ln, Houston, TX 77022: Closed $105,000. Strong entry-level rental or light rehab opportunity. ARV about $220,000.

18418 Tranquility Dr, Humble, TX 77346: Closed $285,000. Good value-add potential in a stable suburban market. ARV about $435,000.

335 Haymarket Ln, Houston, TX 77015: Closed $171,000. Light renovation potential with solid resale margins. ARV about $280,000.

2713 Raymond St, Pasadena, TX 77506: Closed $102,000. Deep value opportunity in an investor-friendly neighborhood. ARV about $230,000.

14206 Langbourne Dr, Houston, TX 77077: Closed $246,000. Strong west-Houston location with upscale renovation upside. ARV about $385,000.

These transactions reflect the range of investor opportunities we help buyers access across the Houston metro. Each offered a different strategy based on price point, condition, and exit plan.

Newer or First-Time Investor

What you’ll learn

• How investor deals differ from retail listings

• The basics of cash and hard money purchases

• What to expect from Houston-area fix-and-flip or buy-and-hold properties

What’s next

Before we send any opportunities, we’ll set up a brief call or Zoom to review your goals and confirm your buying criteria. From there, we’ll outline the next step to start seeing deals that match your profile. Click here for answers to the top 5 questions new investors ask.

Experienced Investor

What you’ll get

• Access to verified investment opportunities across Houston

• Property summaries including ARV ranges, repair estimates, and exit comps

• Direct contact for time-sensitive opportunities (cash or hard-money buyers only)

What’s next

Before sharing any addresses or deal sheets, we’ll schedule a brief call to confirm your buy box, funding readiness, and timeline. After that, we’ll make sure relevant opportunities that match your criteria are brought to your attention quickly.

Most investors prefer to start by text so we can set a time that fits both schedules.

Trusted by investors since 2011 — connecting buyers to real opportunities before they hit the MLS.

Since 2011, I’ve helped serious buyers secure the kinds of off-market properties that rarely reach the MLS. My background in investing, sales, and analysis helps me connect cash and hard-money buyers to real opportunities that move fast and close smoothly. Investors work with me because I keep things simple, direct, and focused on results.

Many of the investors I work with got into real estate for the same reason I wrote RIGGED — to take control of their future instead of letting Wall Street do it for them. It explains how the same systems that control jobs, housing, and money are designed to keep everyday people stuck — and how understanding those mechanics helps you play the game differently. The same principles apply in real estate investing: once you understand how incentives shape the market, you can move faster, negotiate smarter, and build leverage instead of chasing luck. Readers have called RIGGED “a wake-up call” and “the red-pill book for anyone serious about escaping the system.”

Copyright 2026. All rights reserved.

Broker: Levitate Real Estate | 9595 Six Pines Dr Bld 8 Suite 8210, The Woodlands, TX 77380

Texas Real Estate Commission Information About Brokerage Services and Consumer Protection Notice